The Loan Calculator Mortgage Apps latest version is a highly practical loan calculator software designed specifically for users who need to calculate various loan parameters. By entering crucial information such as loan amount, interest rate, and repayment period, users can quickly obtain essential data such as the monthly repayment amount, total repayment amount, and total interest incurred over the repayment period.

This software stands out with its intuitive user interface and robust computing capabilities, allowing users to make more informed loan decisions effortlessly.

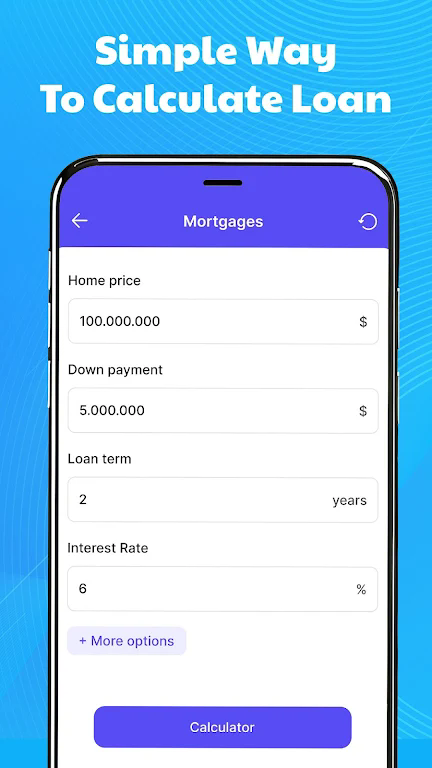

1. After users input the basic loan parameters, the software can rapidly generate a detailed repayment plan and cost analysis.

2. The apps simple and intuitive design ensures that all users can easily get started and complete loan calculations without facing complex operations.

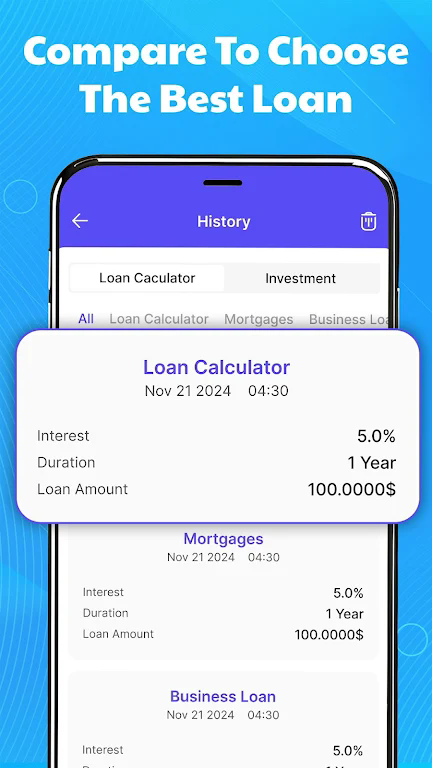

3. Beyond basic loan calculations, the software also offers additional tools such as loan comparisons and early repayment calculations.

1. The software provides a comprehensive breakdown of monthly repayments, including details on principal, interest, and the remaining principal balance.

2. Users can input or adjust parameters like loan amount, interest rate, and repayment period based on their actual situation.

3. Loan data are visually presented in graphical formats, enabling users to more intuitively understand the implications of their loans.

1. Users need to input basic information such as loan amount, interest rate, and repayment period initially.

2. Users can optionally add additional calculation functions, such as early repayment, according to their specific needs.

3. Once calculations are completed, users can view a detailed repayment plan and have the option to export the results in various formats.

1. Users should understand how different parameters, such as interest rates and repayment terms, impact the total repayment amounts to make more appropriate loan choices.

2. By utilizing the loan comparison tool within the software, users can evaluate the cost-effectiveness of different loan options.

3. As market conditions change, users should regularly review and update their loan plans to ensure they are making the best financial decisions.

Android

Name(Your comment needs to be reviewed before it can be displayed) Reply [ ] FloorCancel Reply