At Borrowell, our mission is to empower every Canadian to achieve their financial goals and dreams. We understand that credit scores are pivotal in the approval process and interest rate determination for various financial products. As the pioneering company in Canada to offer free credit scoring services, Borrowell enables users to check their credit scores regularly. By doing so, users can stay updated on their credit status and take necessary steps to enhance it.

Today, Borrowell stands as the sole provider of weekly updated, complete Equifax Canada credit reports for free. This service ensures that users can constantly monitor their credit status and make informed financial decisions swiftly. With Borrowells suite of tools and resources, managing your credit history, improving your credit score, and enjoying better financial opportunities and interest rates has never been easier.

1. Free Credit Scoring and Reporting: Borrowell delivers free credit scoring and weekly updates of complete Equifax Canada credit reports, ensuring that users are always aware of their credit health.

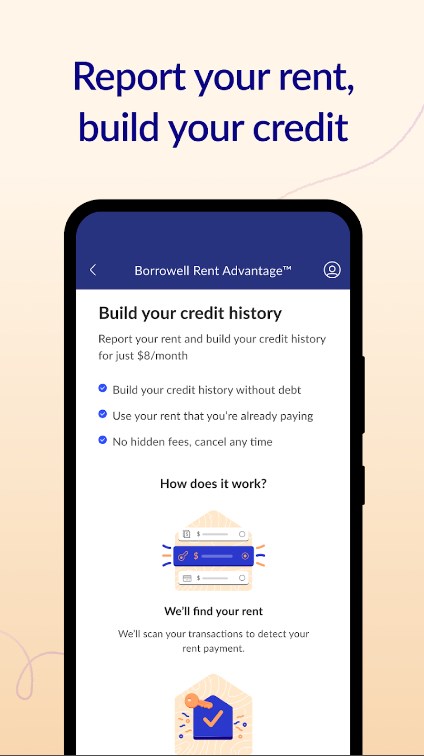

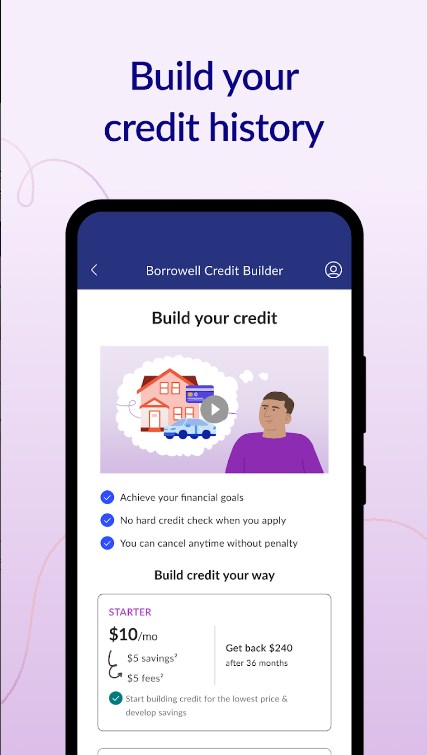

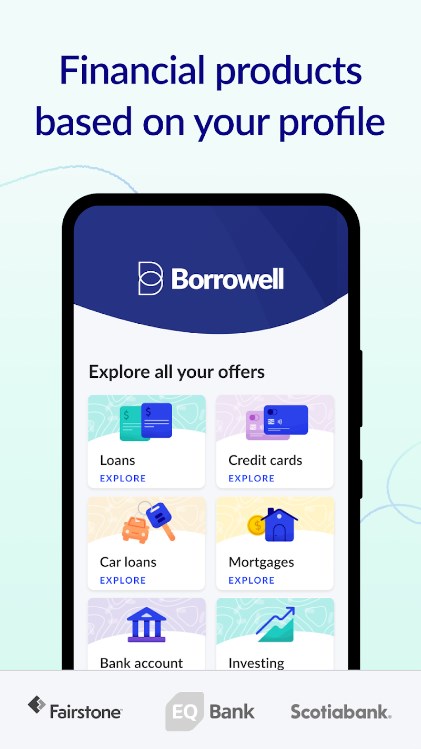

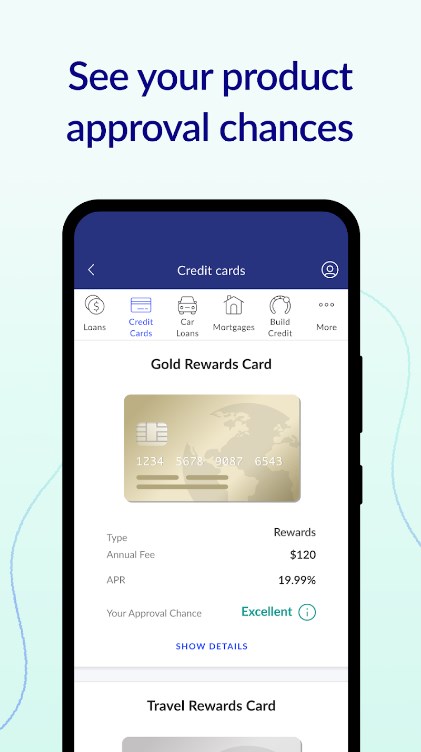

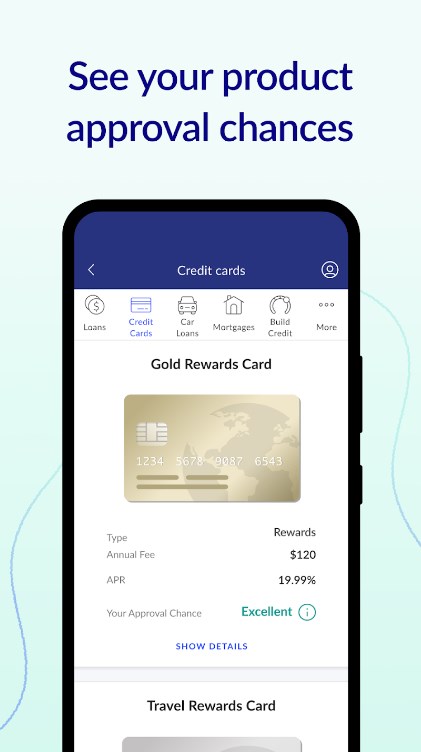

2. Personalized Financial Advice: Based on users credit status and financial goals, Borrowell offers personalized financial advice and product recommendations, including loans, credit cards, and savings accounts.

3. Credit Monitoring and Alerts: Through real-time monitoring of users credit changes, Borrowell provides immediate alerts when any suspicious activity is detected, safeguarding users against potential identity theft or fraud.

1. Easily Check Credit Scores: With a straightforward registration process, users can quickly obtain their credit scores and check updates regularly.

2. Explore Financial Products: Leveraging personalized recommendations from the app, users can find and apply for financial products that best suit their needs, such as low-interest loans and high-return savings accounts.

3. Maintain Credit Health: Borrowells credit monitoring feature helps users stay informed about any events affecting their credit score, allowing them to take proactive measures to maintain or improve their credit health.

1. User-Friendly Interface Design: The application boasts a concise and clear interface, making it easy for users to navigate and manage their credit information and financial advice.

2. Fast Access and Security: Users personal information is secured through encryption technology, ensuring fast and safe access to credit reports and financial advice.

3. Abundant Educational Resources: Borrowell offers a plethora of educational resources on credit management, financial planning, and investment to help users enhance their financial knowledge.

1. The Only Weekly Updated Credit Report Service: Borrowell is the only Canadian company providing complete, weekly updated Equifax credit reports, ensuring users always have the latest credit data.

2. Big Data-Driven Precision Recommendations: Utilizing advanced data analysis technology, Borrowell delivers highly accurate and personalized financial product recommendations based on users credit status.

3. Assisting in Achieving Financial Goals: Borrowell is dedicated to providing users with comprehensive tools and resources to help them manage their finances effectively and achieve greater financial prosperity.

Android

Name(Your comment needs to be reviewed before it can be displayed) Reply [ ] FloorCancel Reply